As part of a strategic merger, Residential Building WA has been absorbed by Residential Attitudes, a proud member of the JWH Group. To ensure a seamless transition and provide you with an enhanced experience, we are redirecting you to the Residential Attitudes website.

Here you will find an array of inspiring designs, house and land packages and a team of professionals ready to guide you through the home-building process. Our goal remains unchanged: to create homes that inspire, reflect your individuality and bring your home vision to life.

TAILORED LIVING, BOLD CHOICES, AND EXPERIENCED EXCELLENCE!

Looking for a new home-building specialist? Residential Attitudes has ranges to suit a number of lifestyles and life stages.

Single or two-storey? Narrow lot or rear? First home buyer, turnkey or investment? No matter your situation, we have the perfect new home for you.

And as part of one of Western Australia’s largest home builders, you can feel the confidence that comes from knowing you are in experienced hands.

Whether you are looking for a single-storey, double-storey or house and land package we have all you need and more!

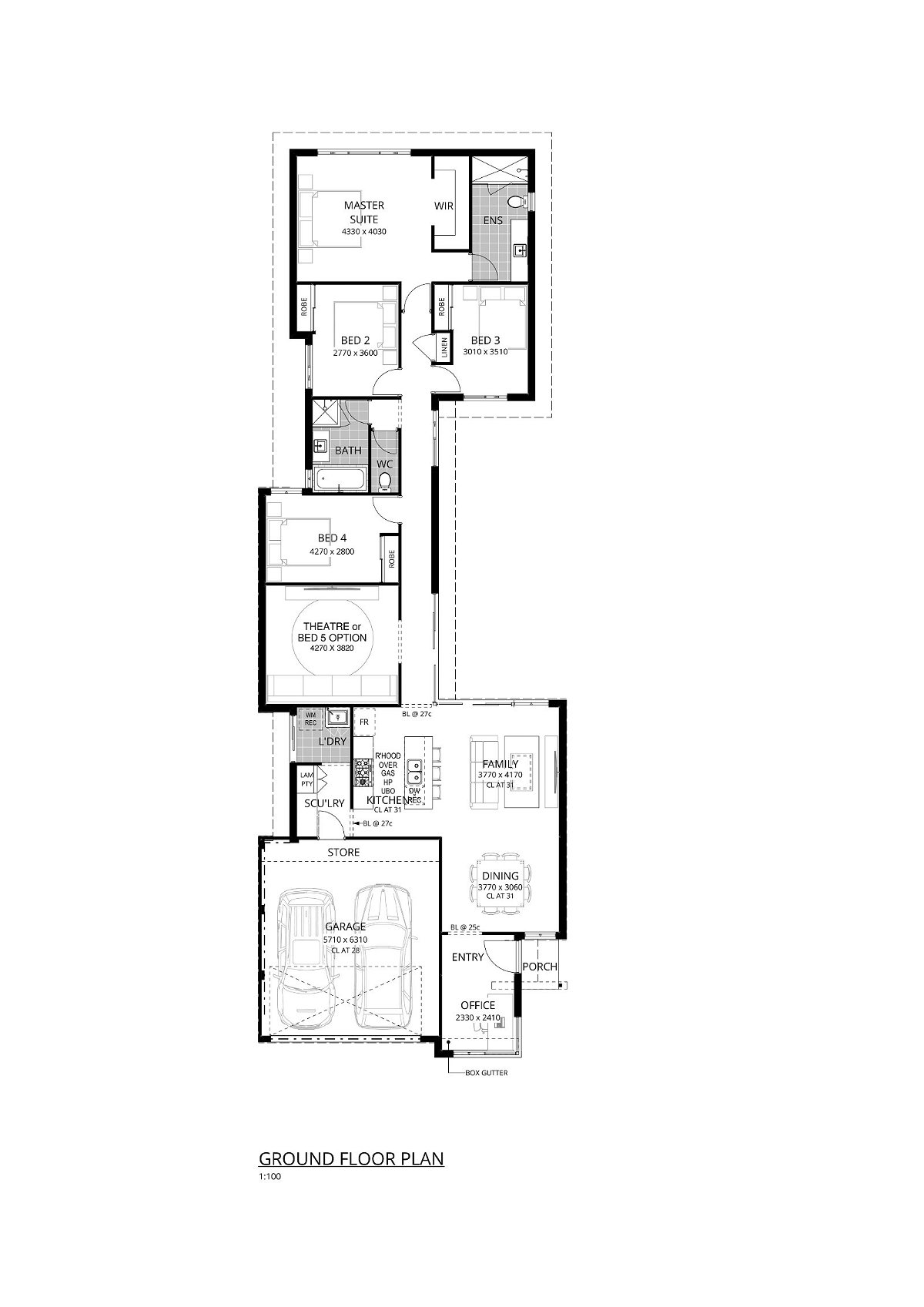

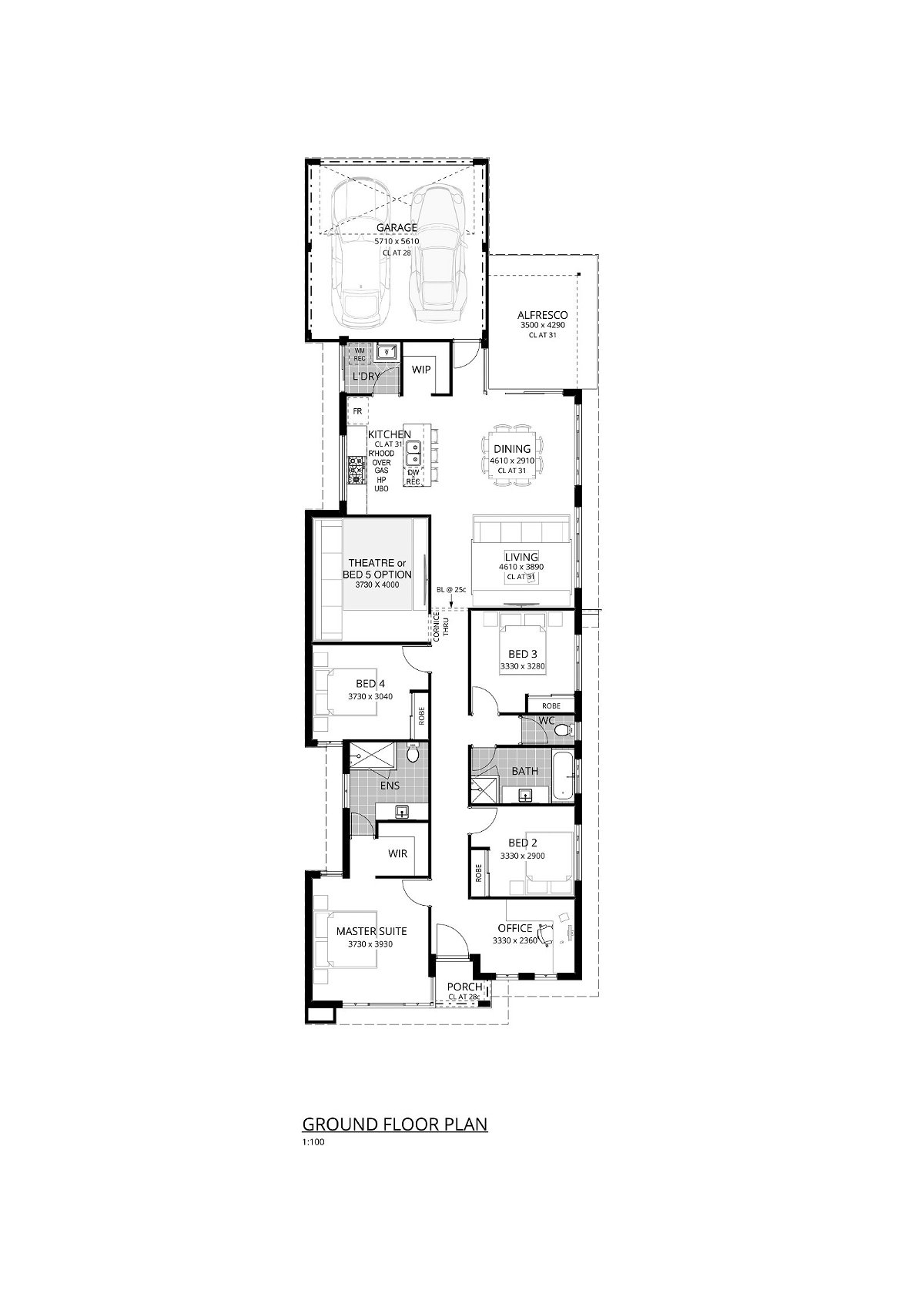

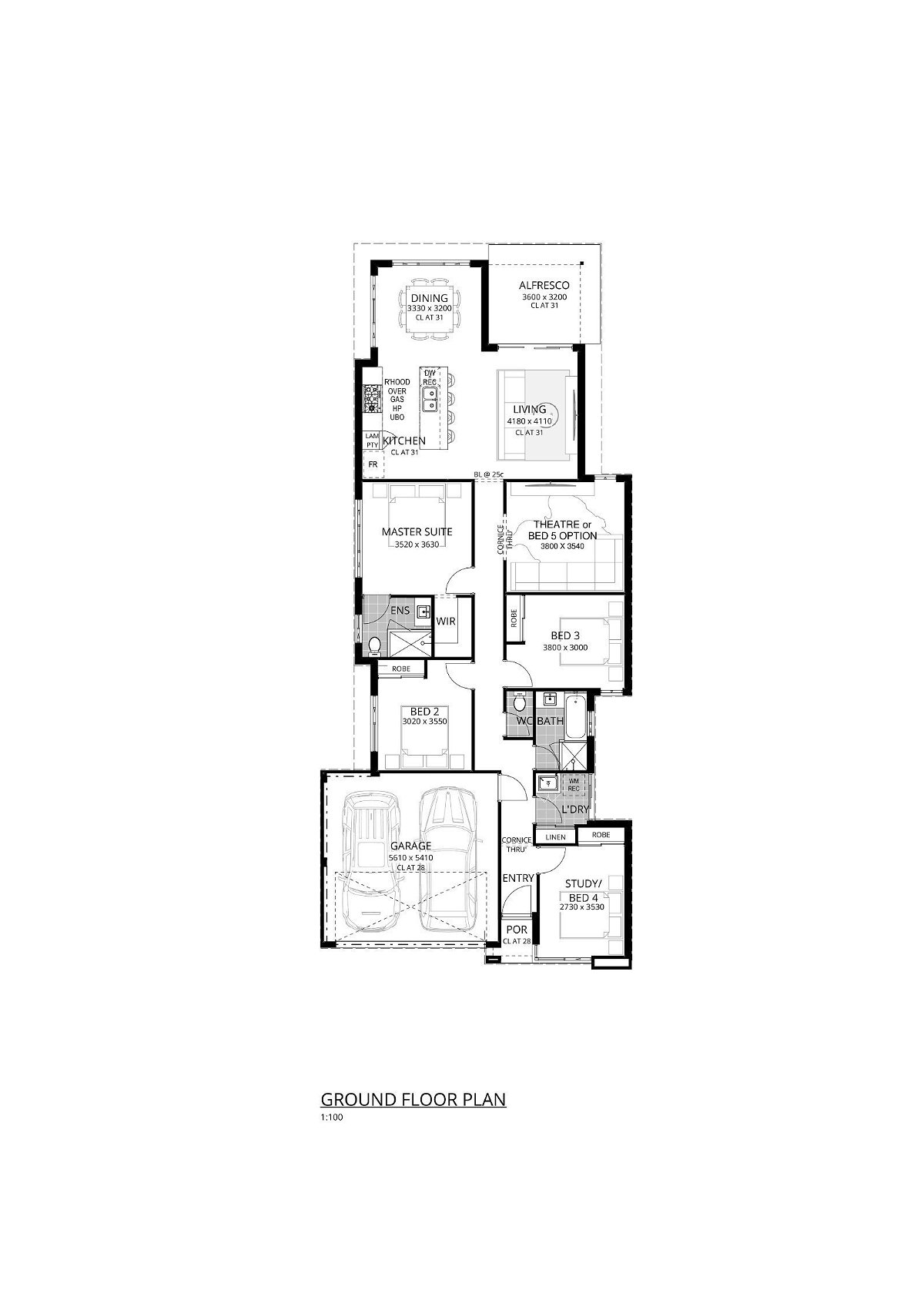

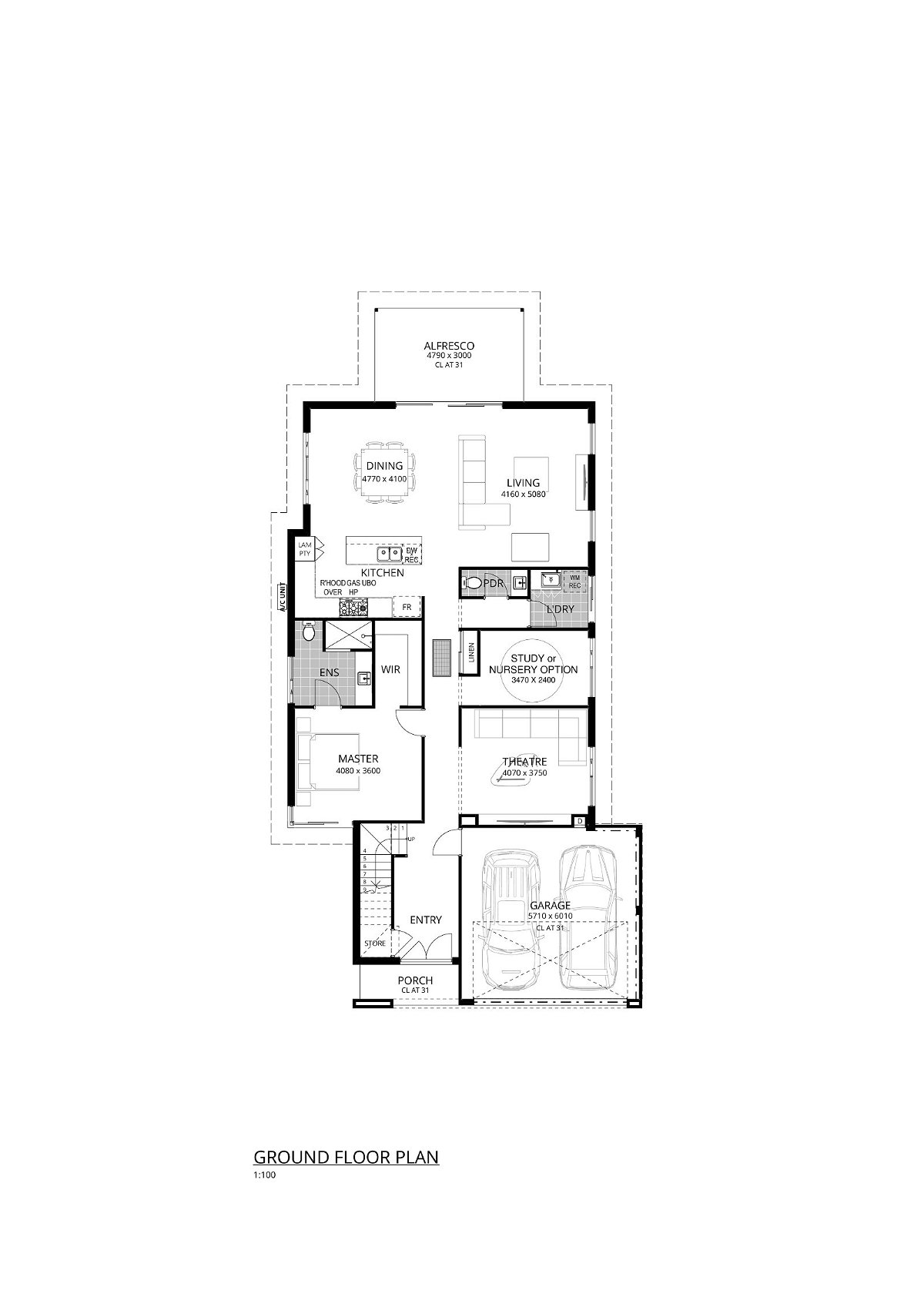

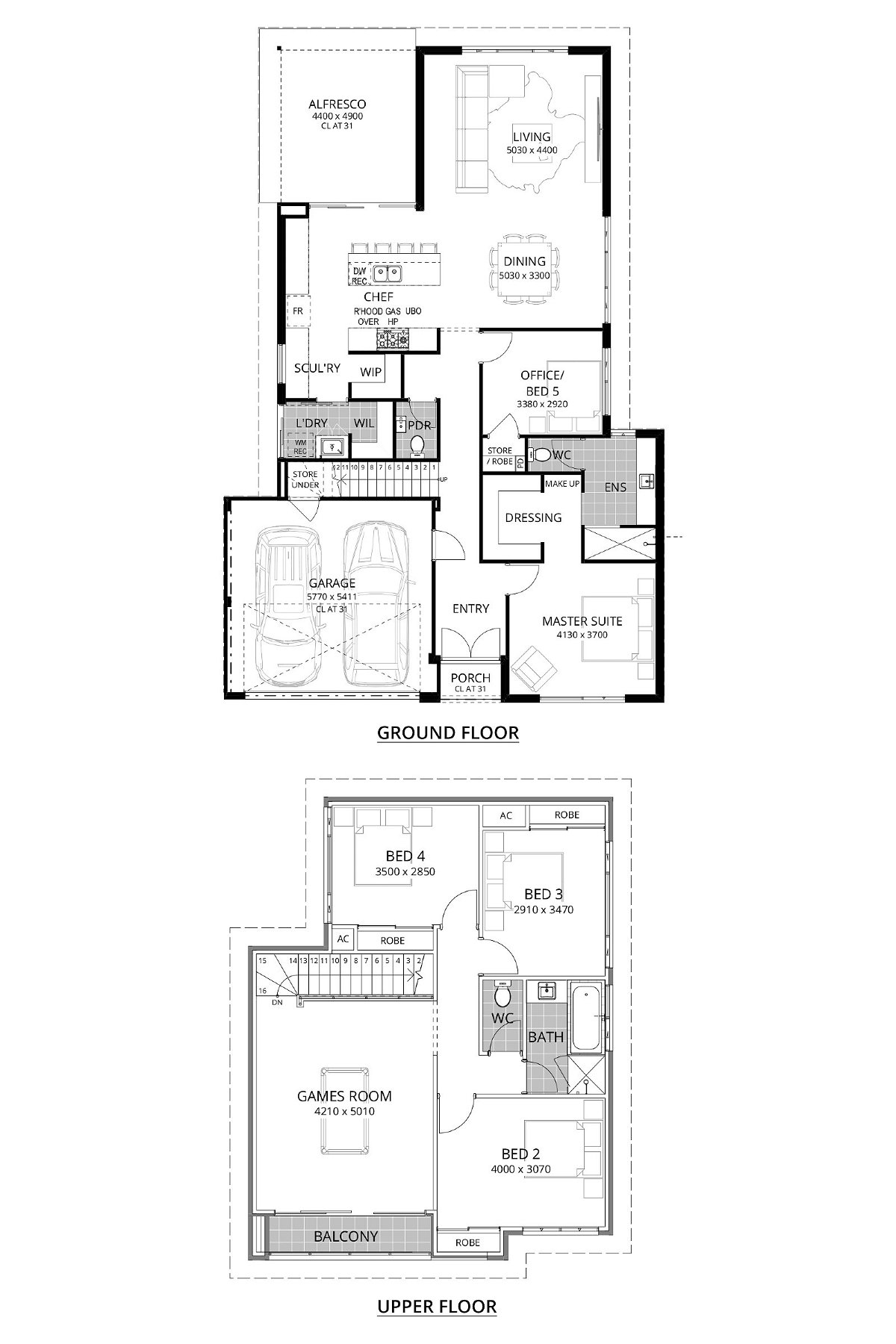

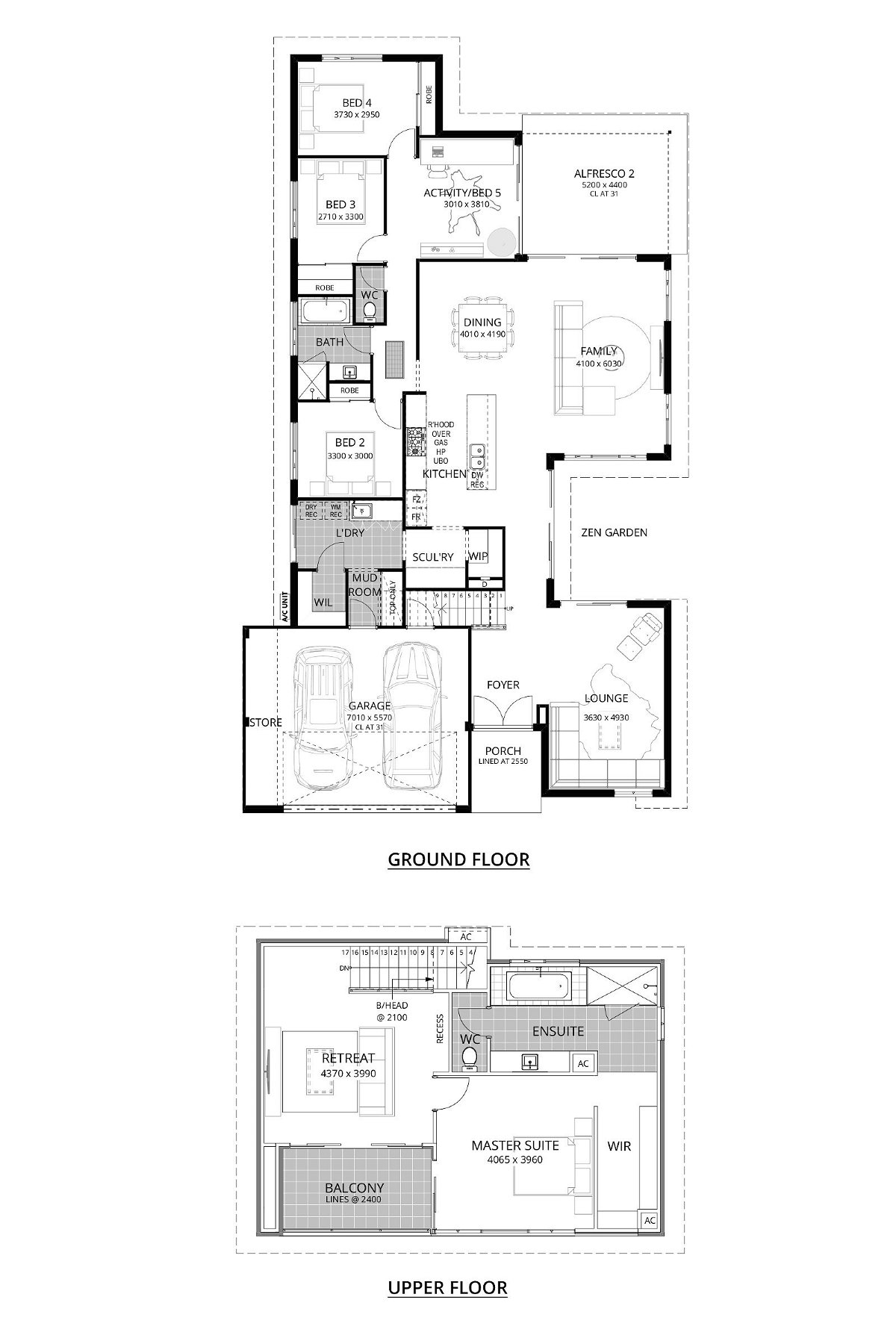

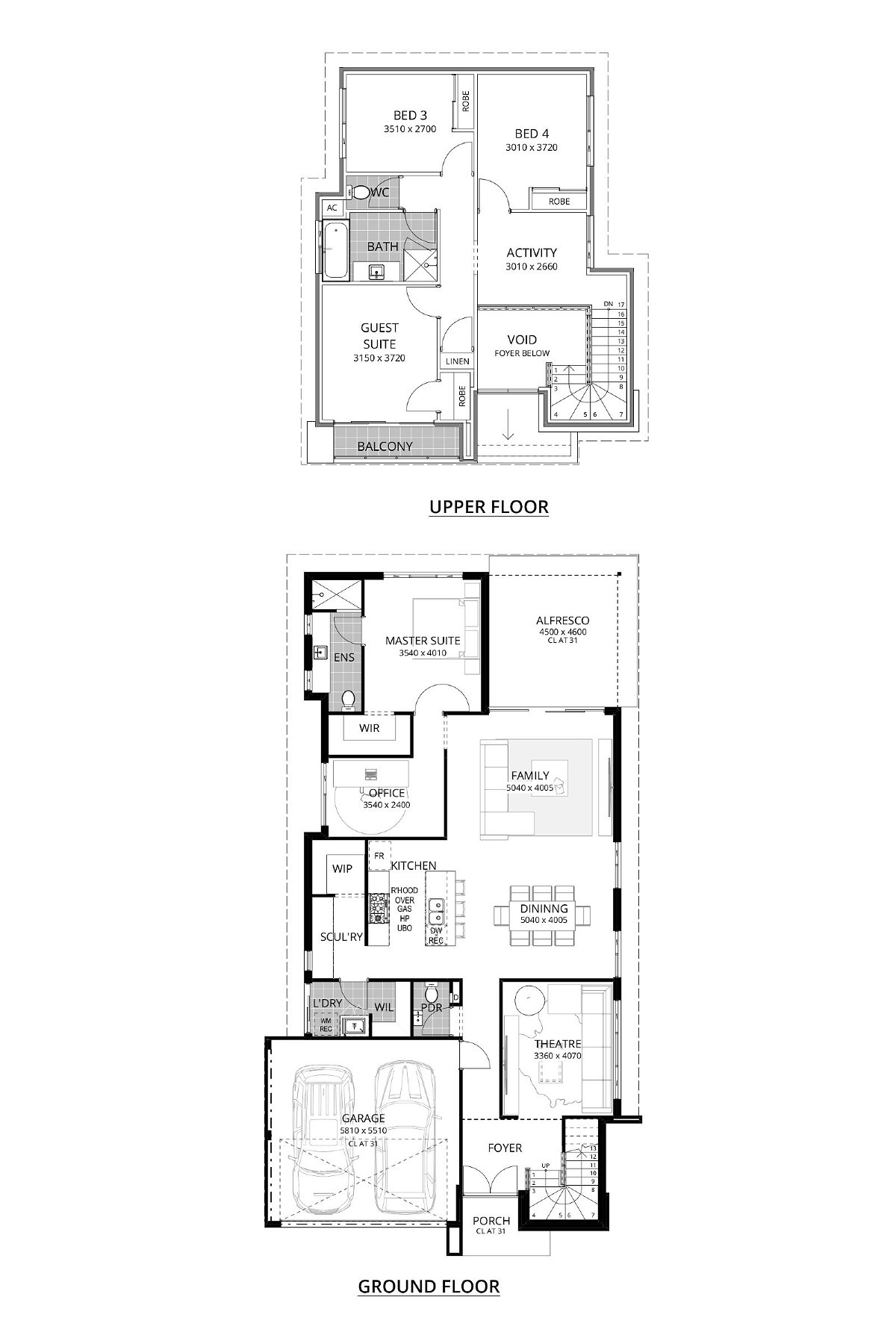

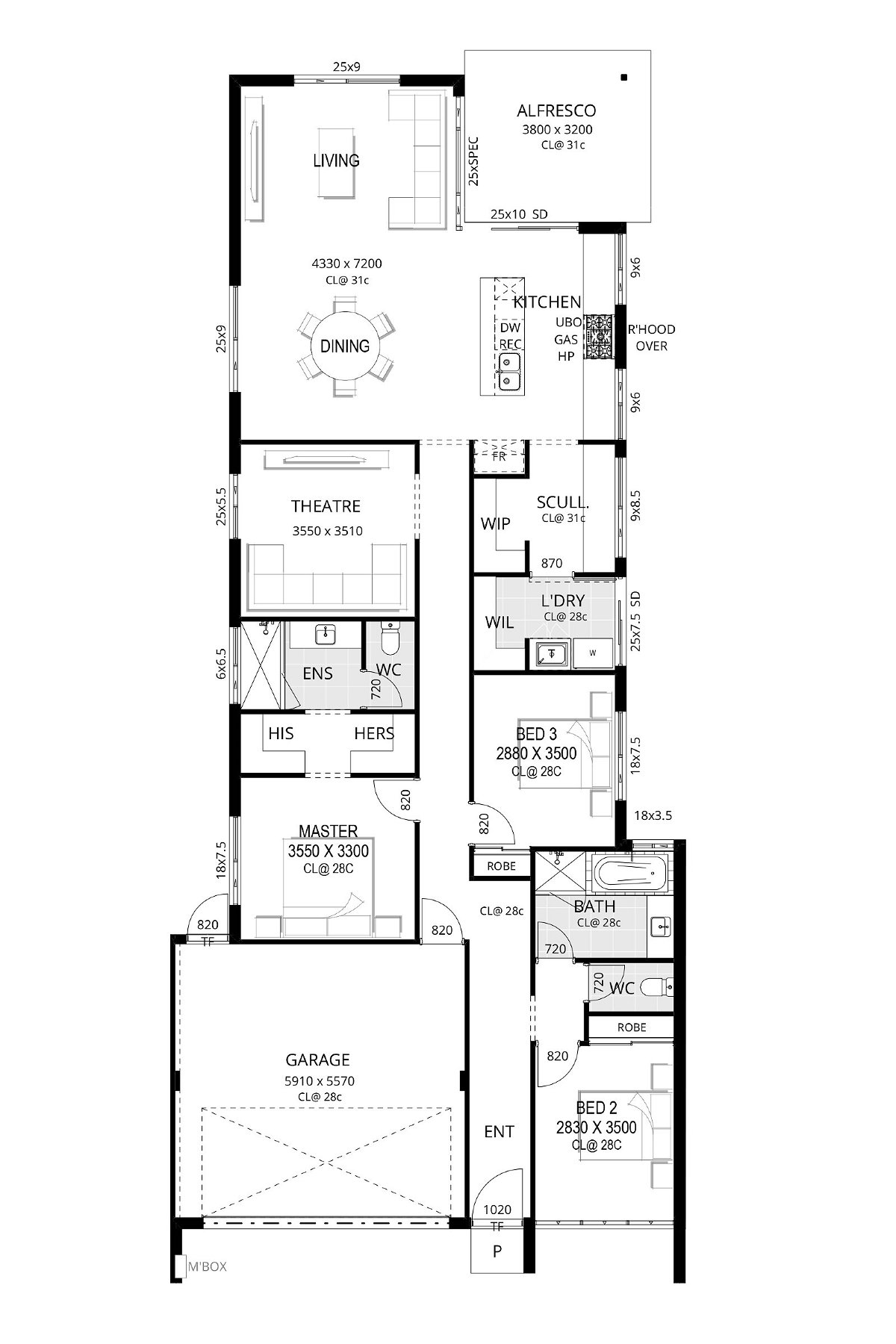

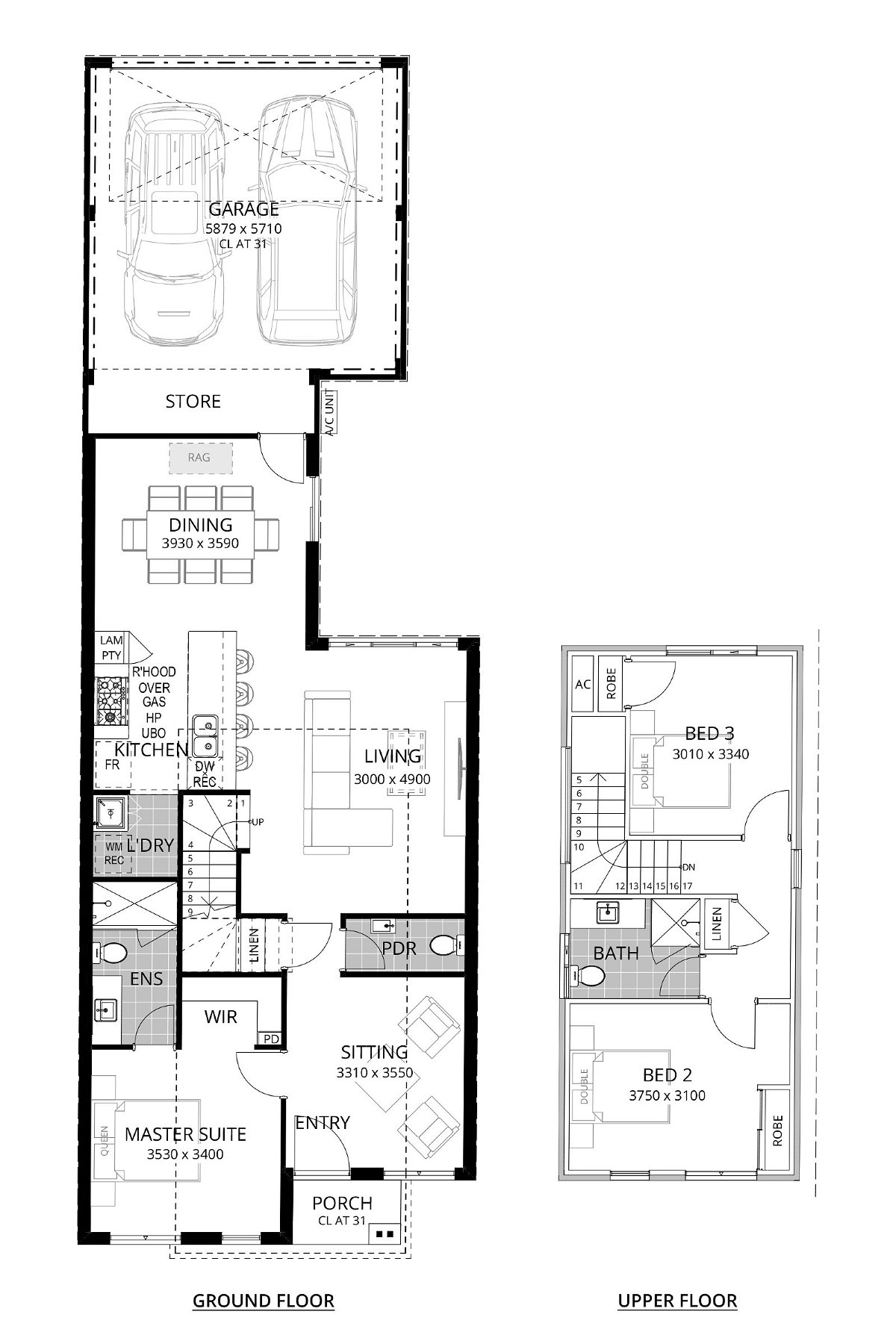

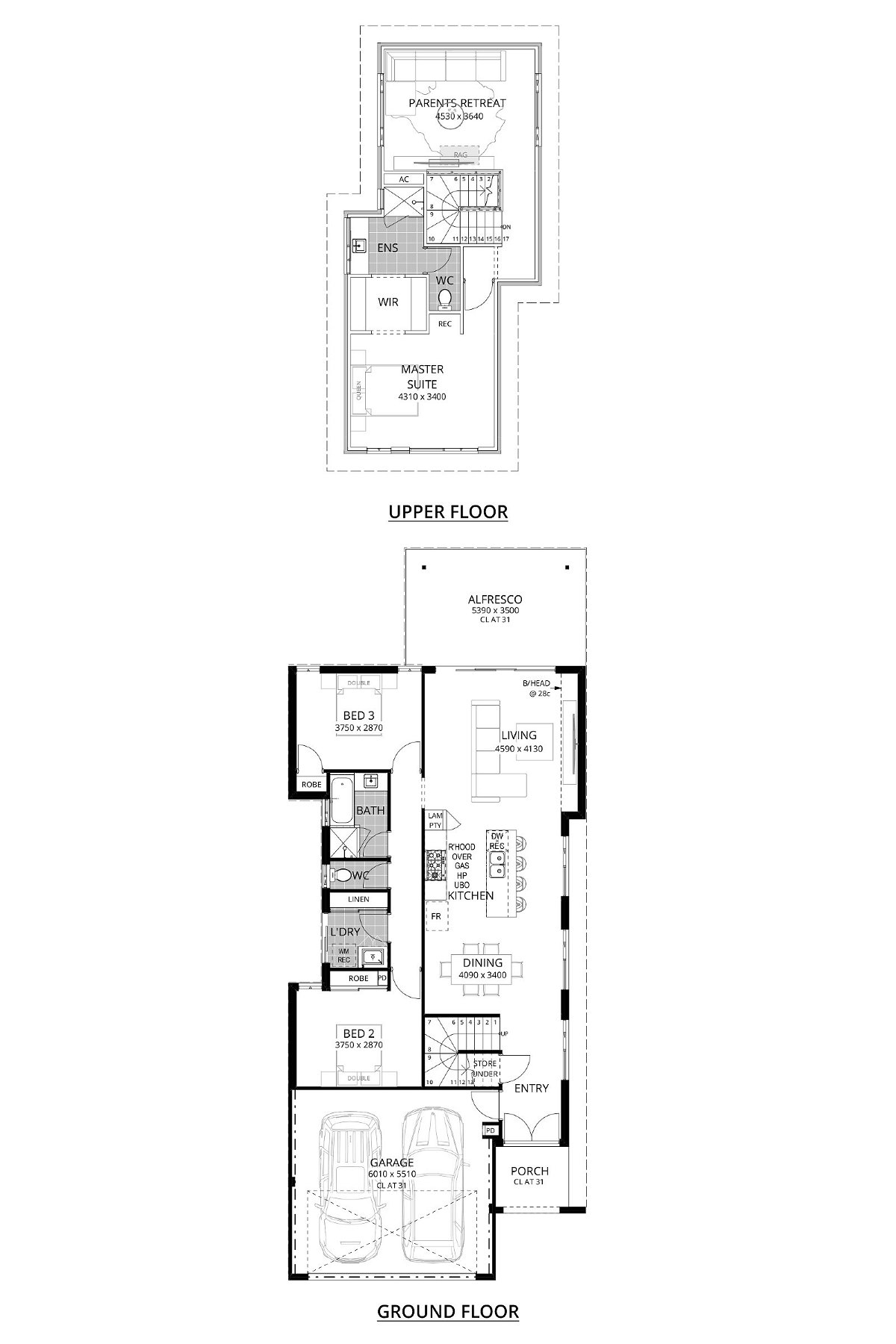

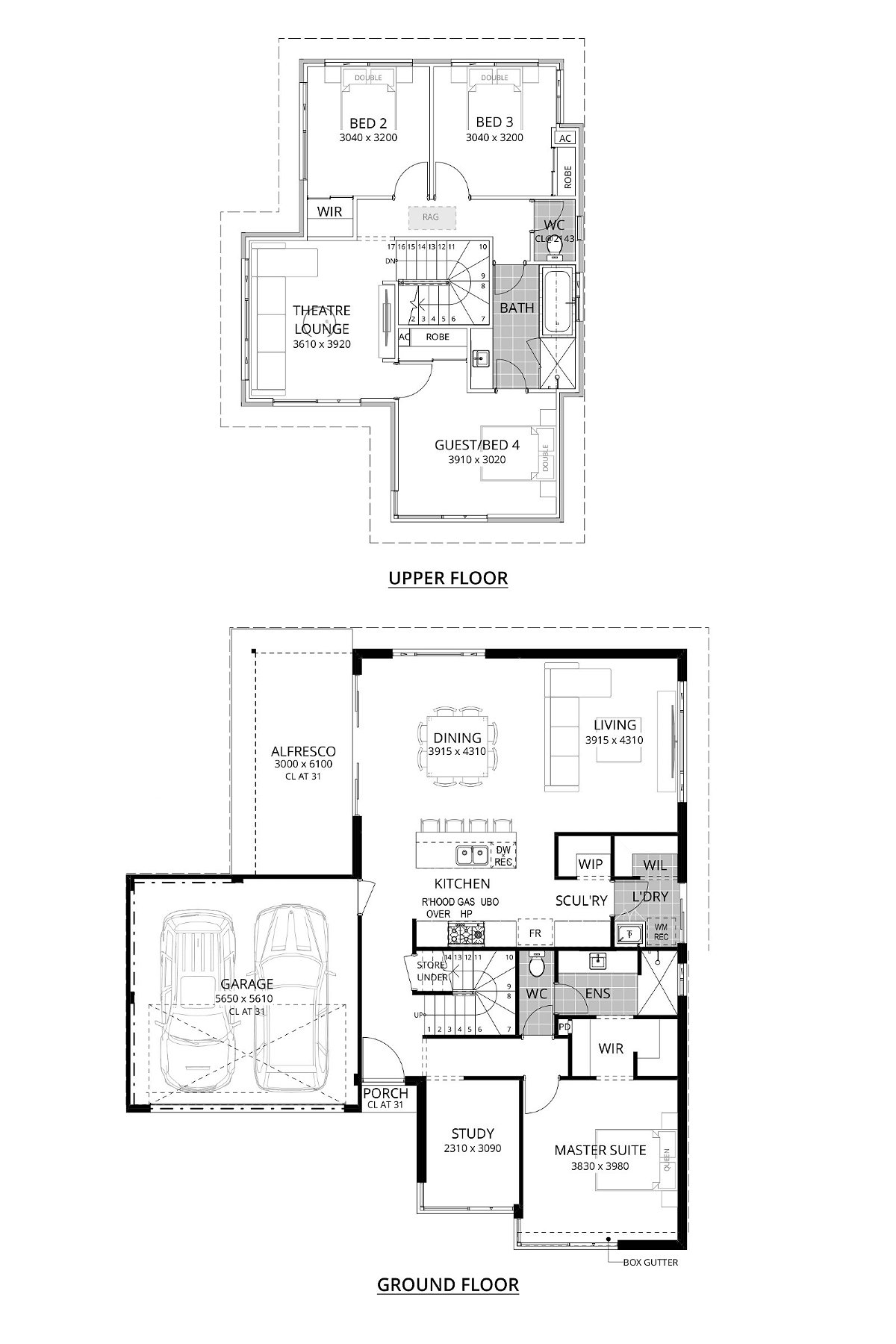

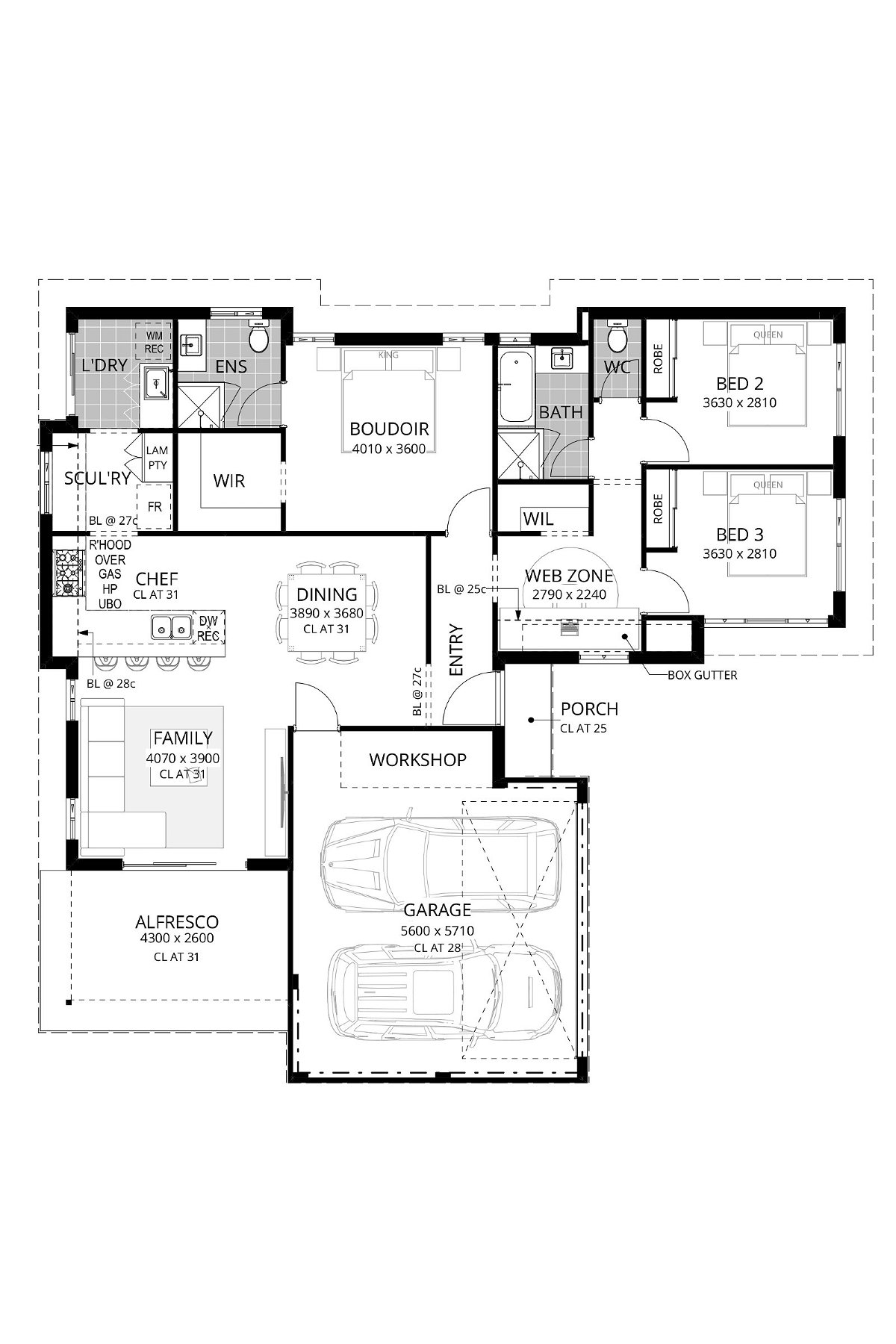

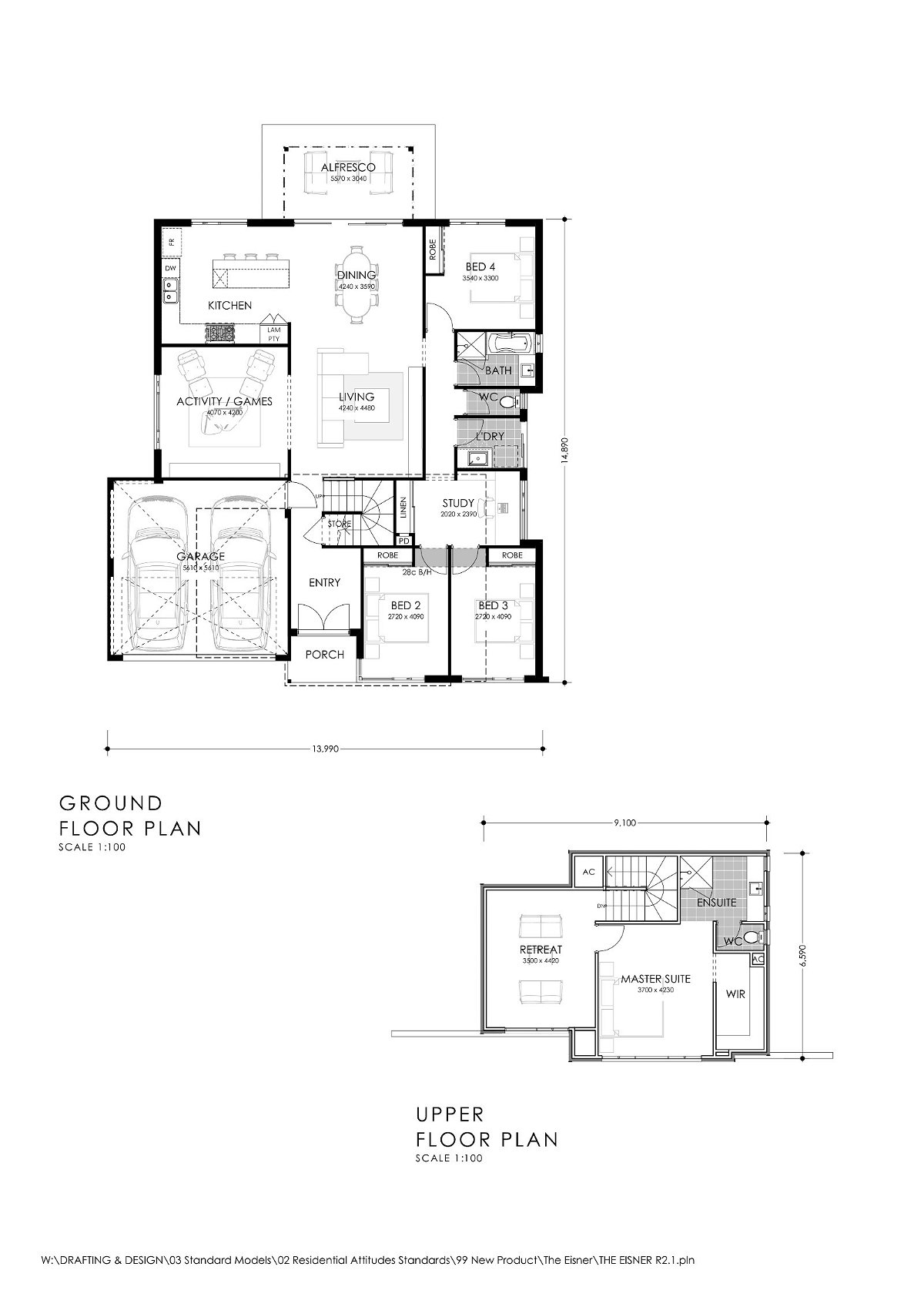

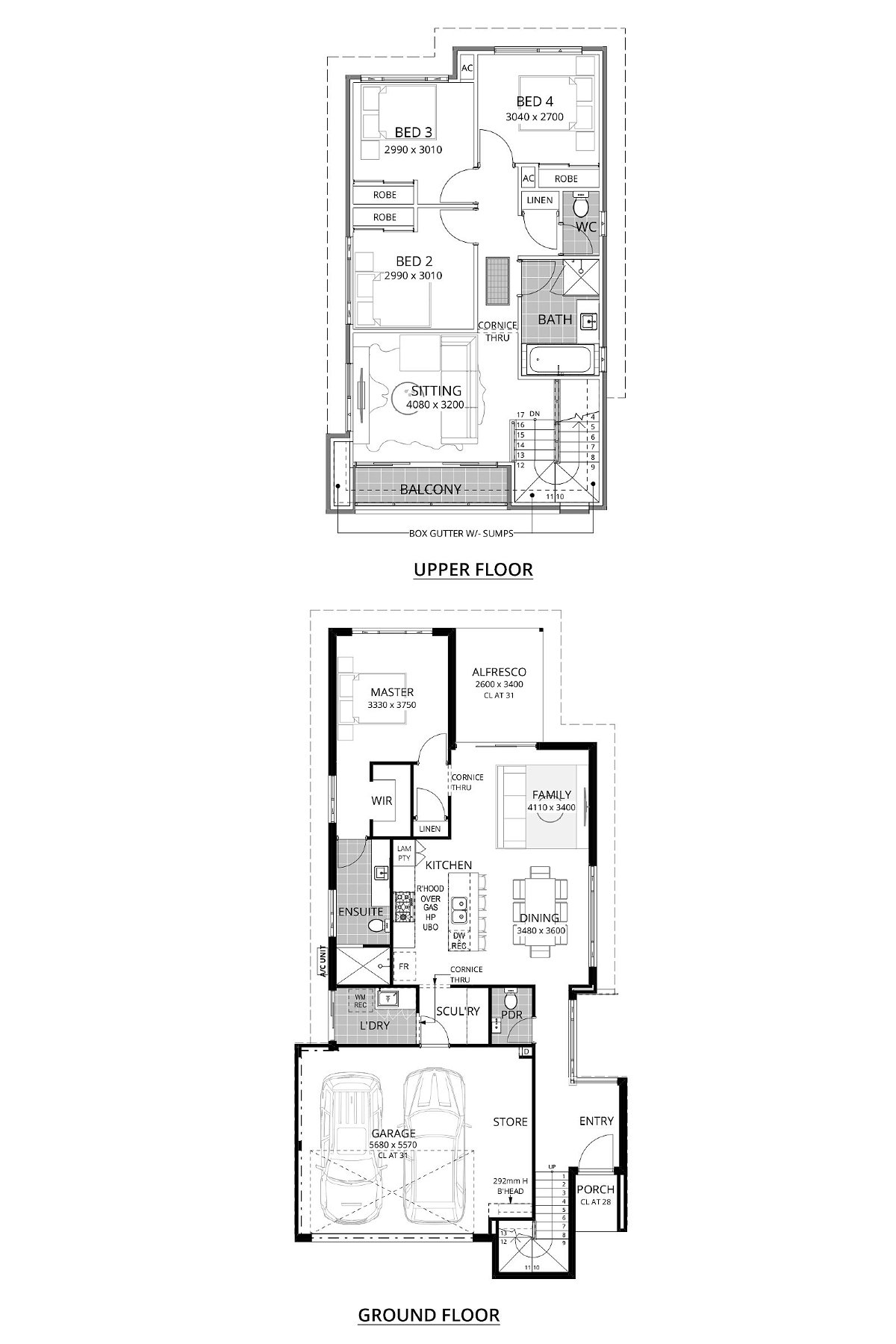

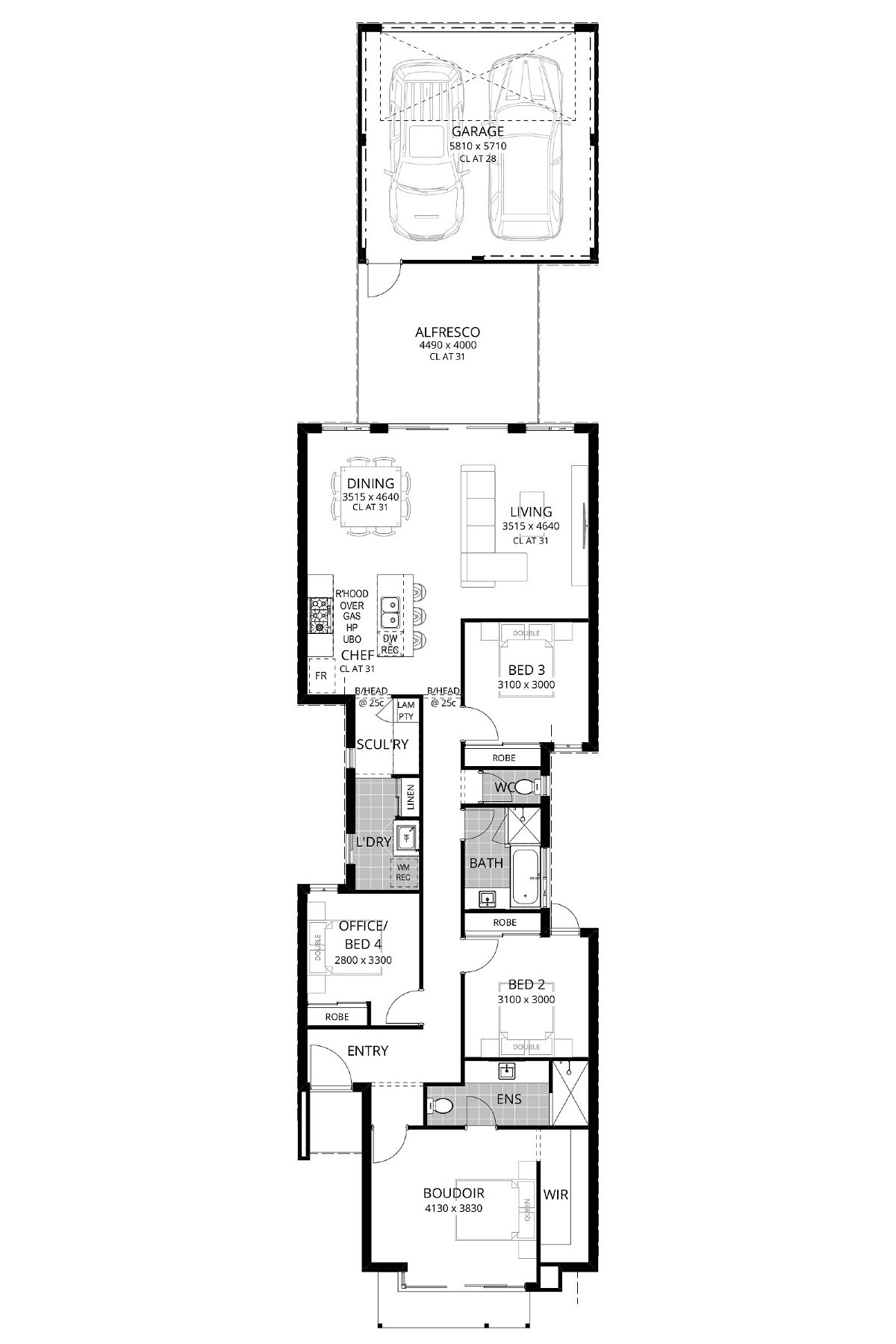

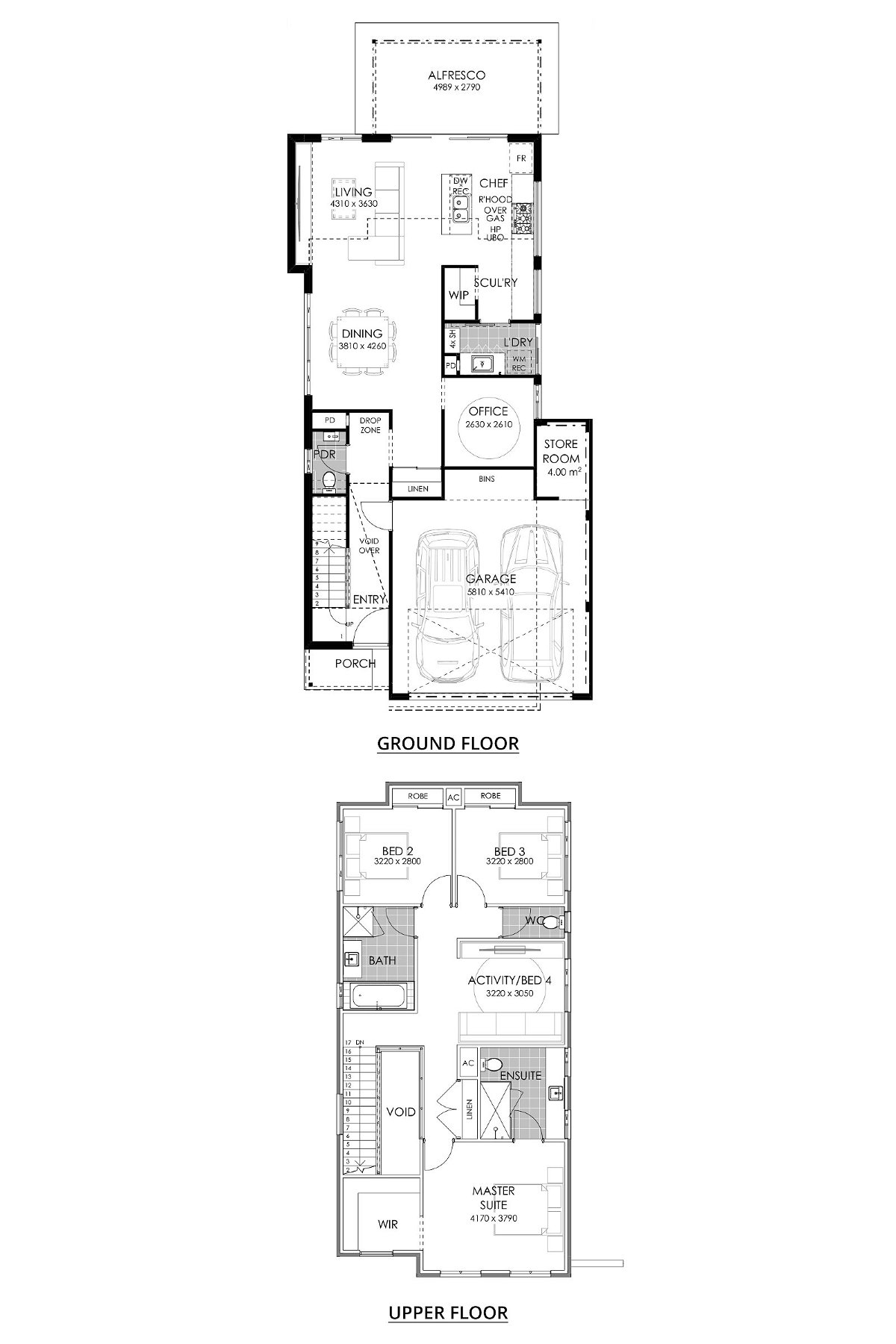

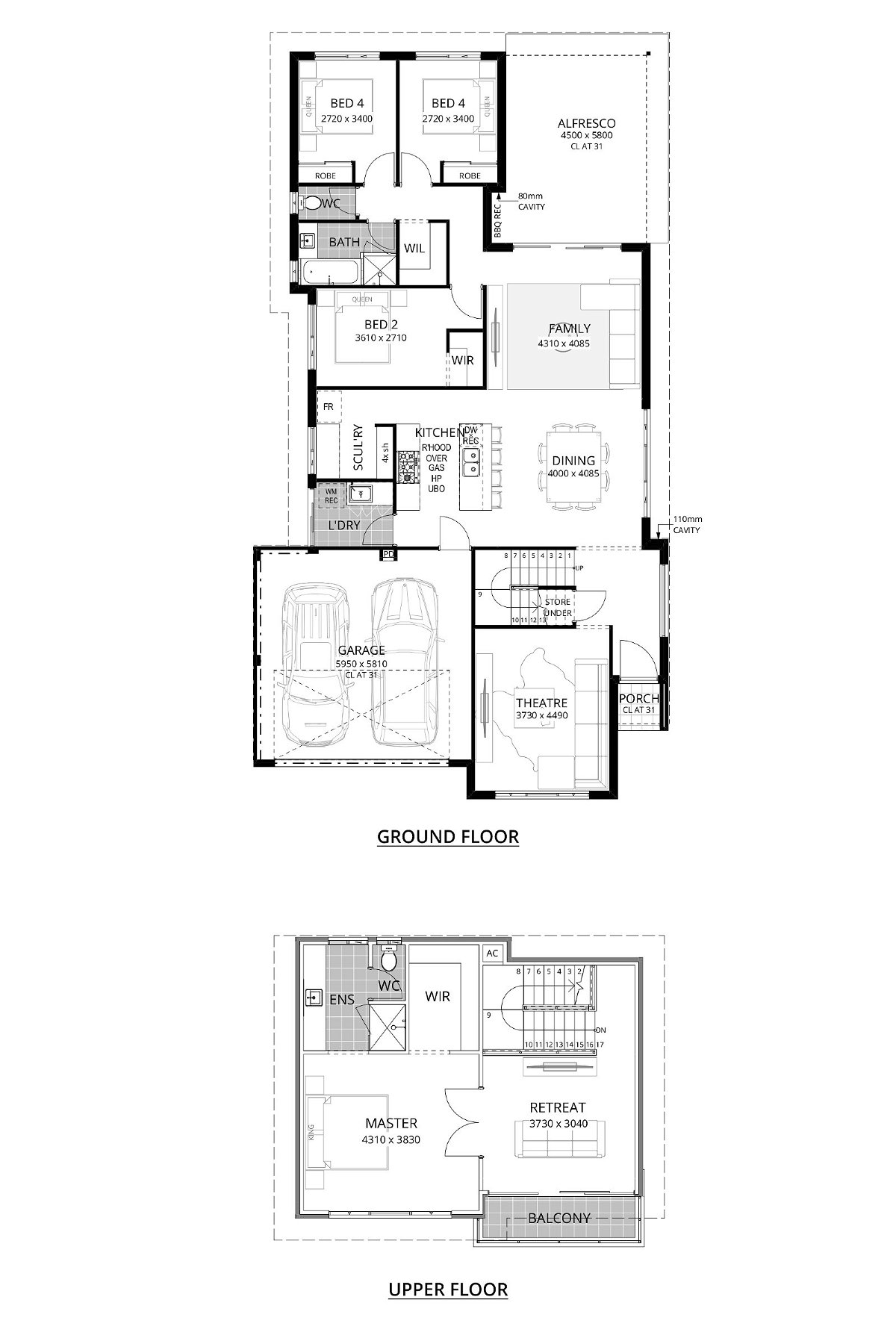

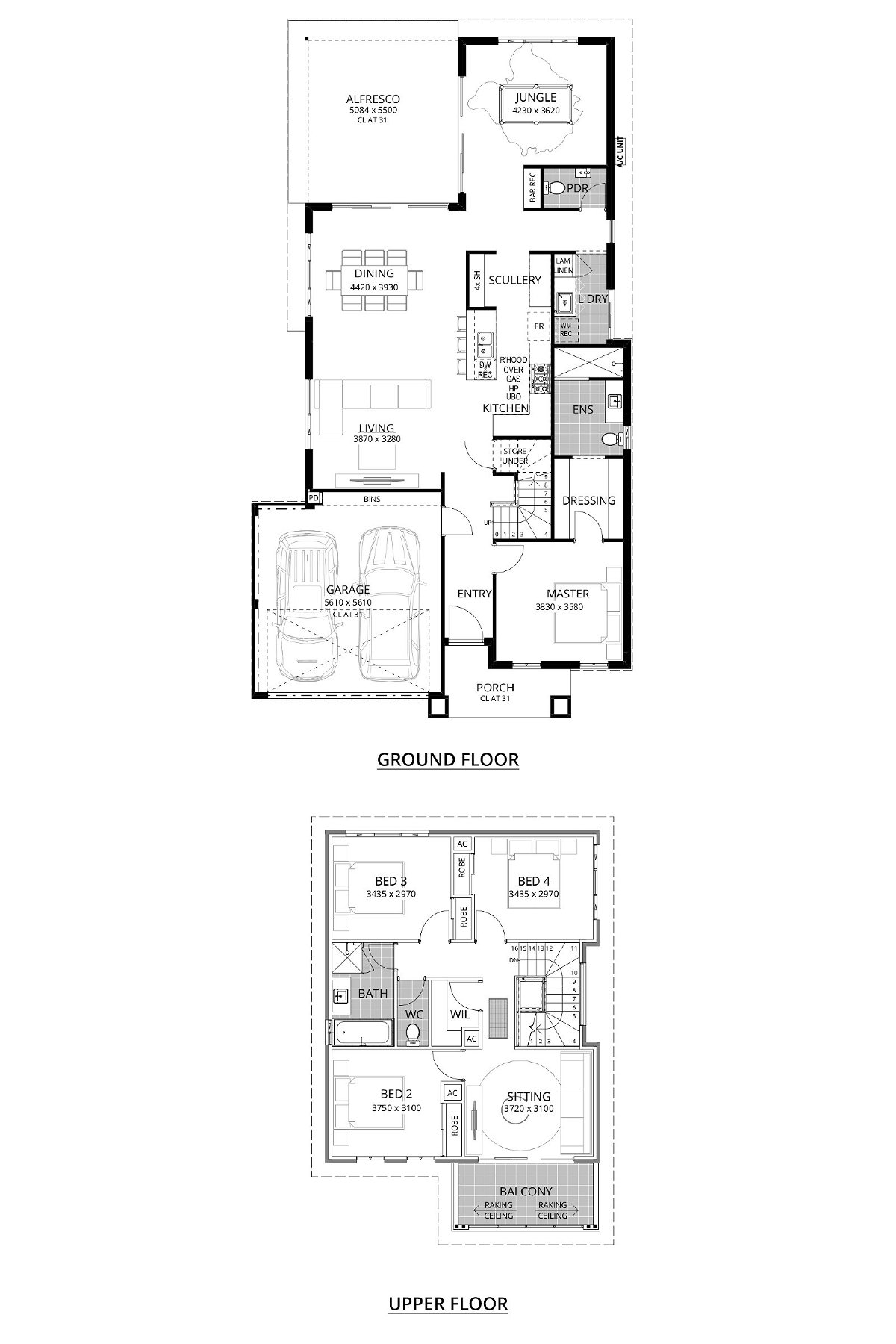

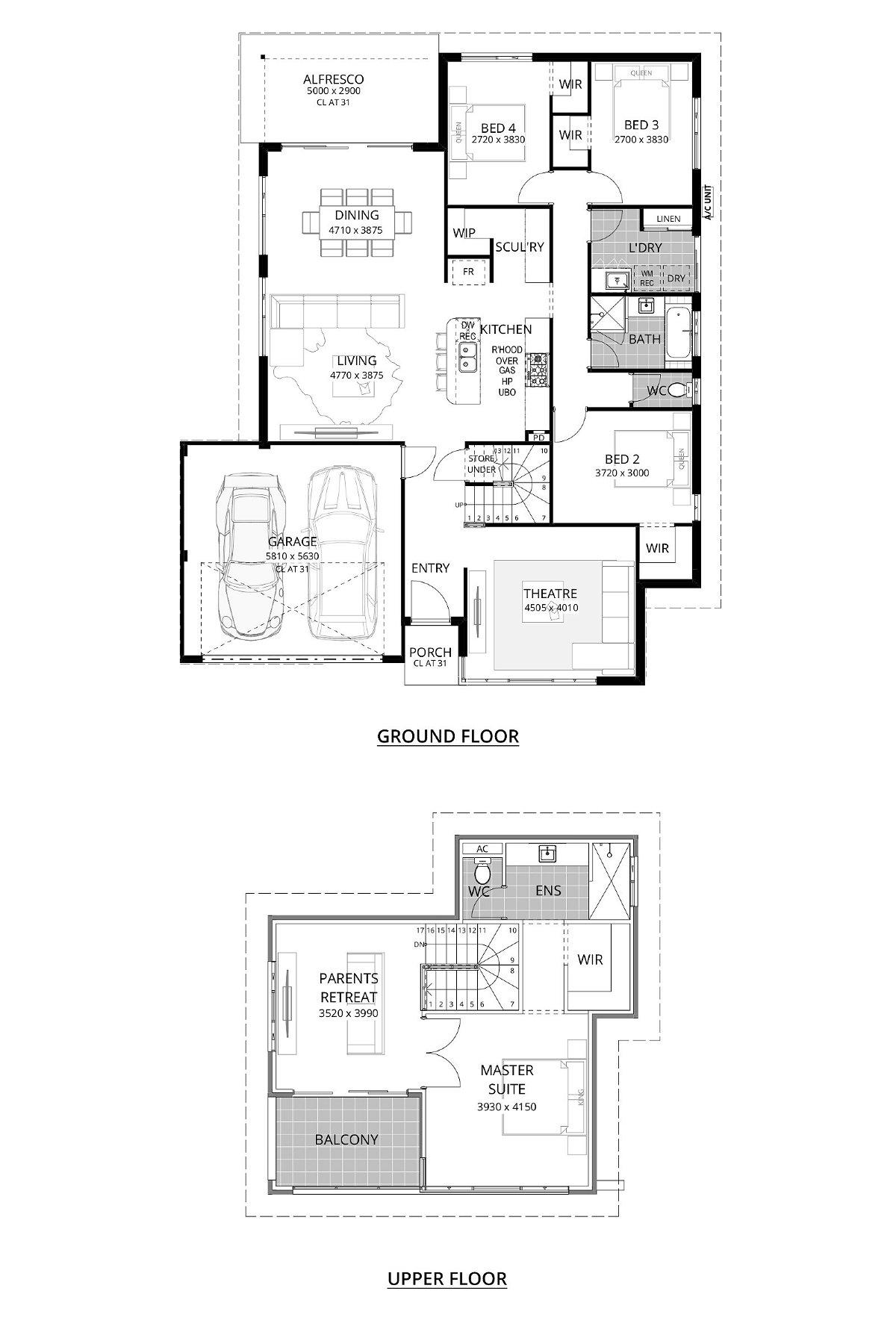

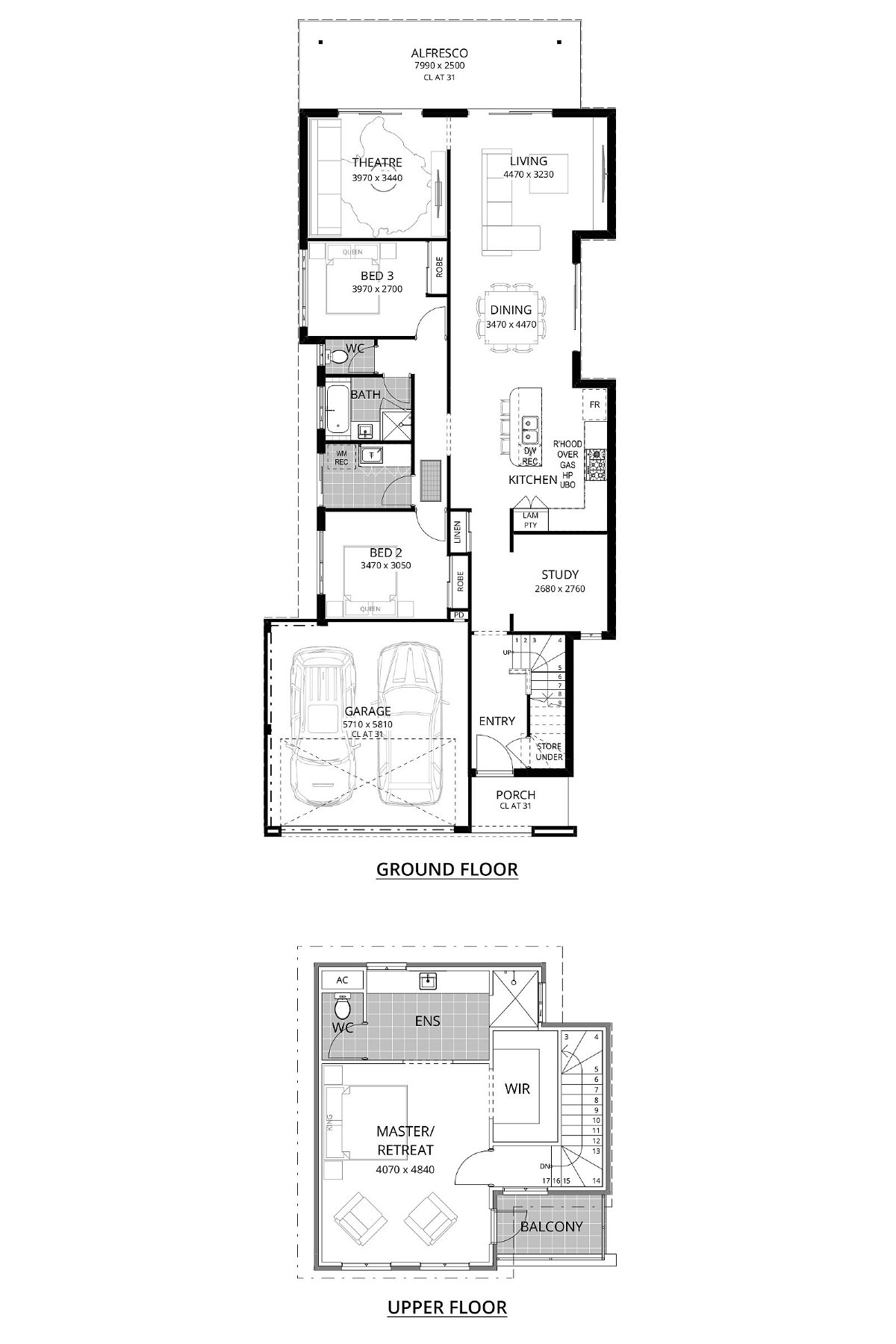

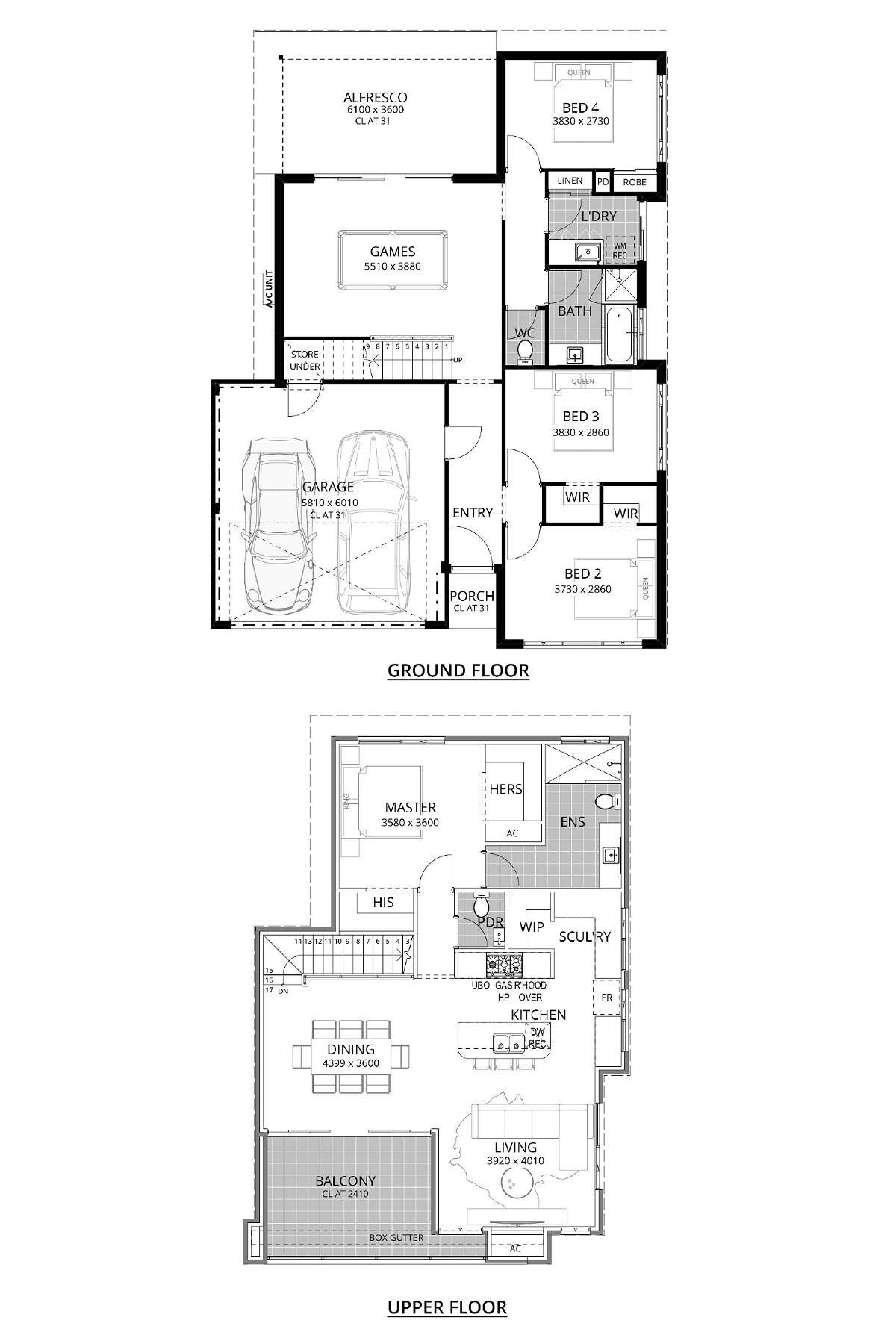

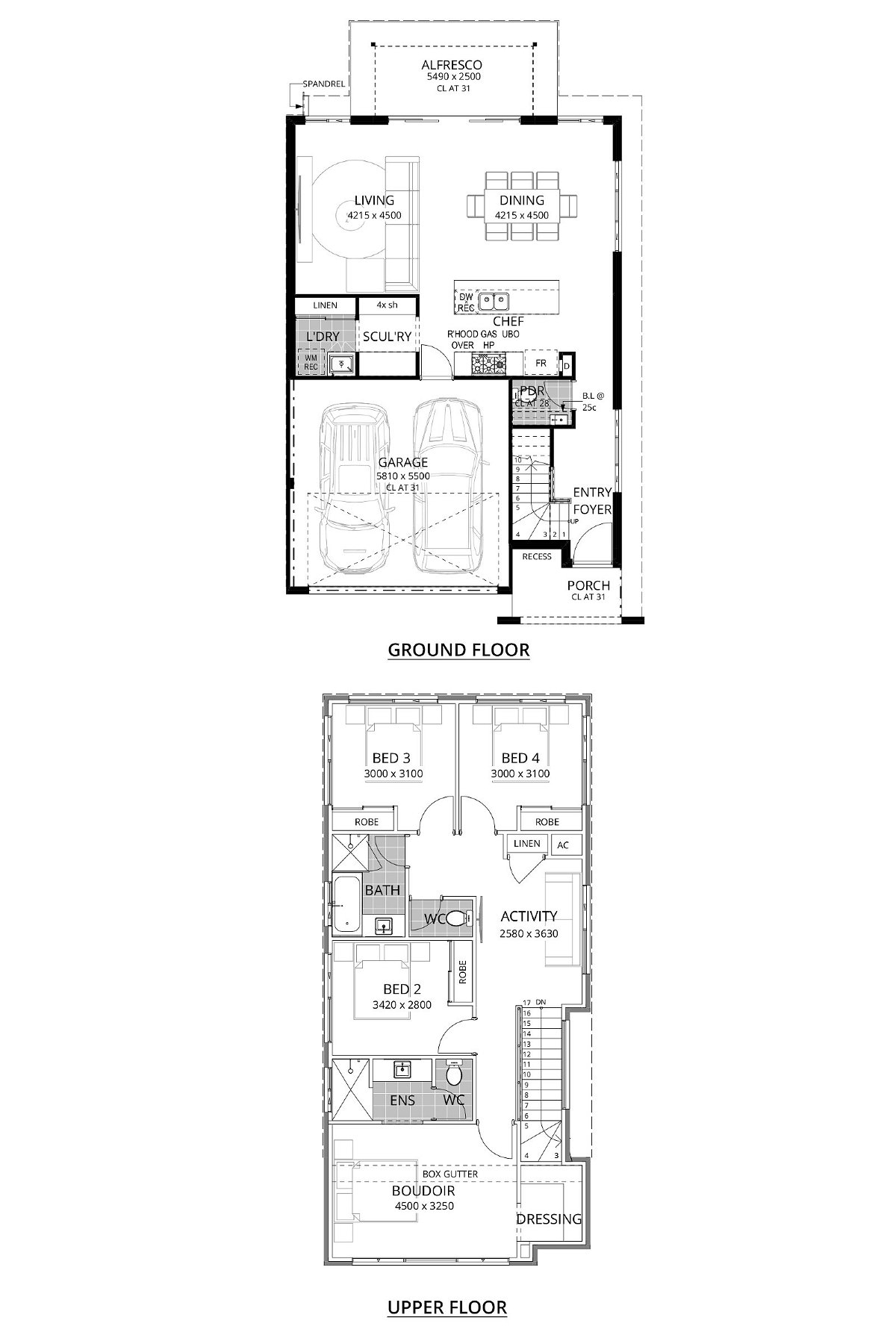

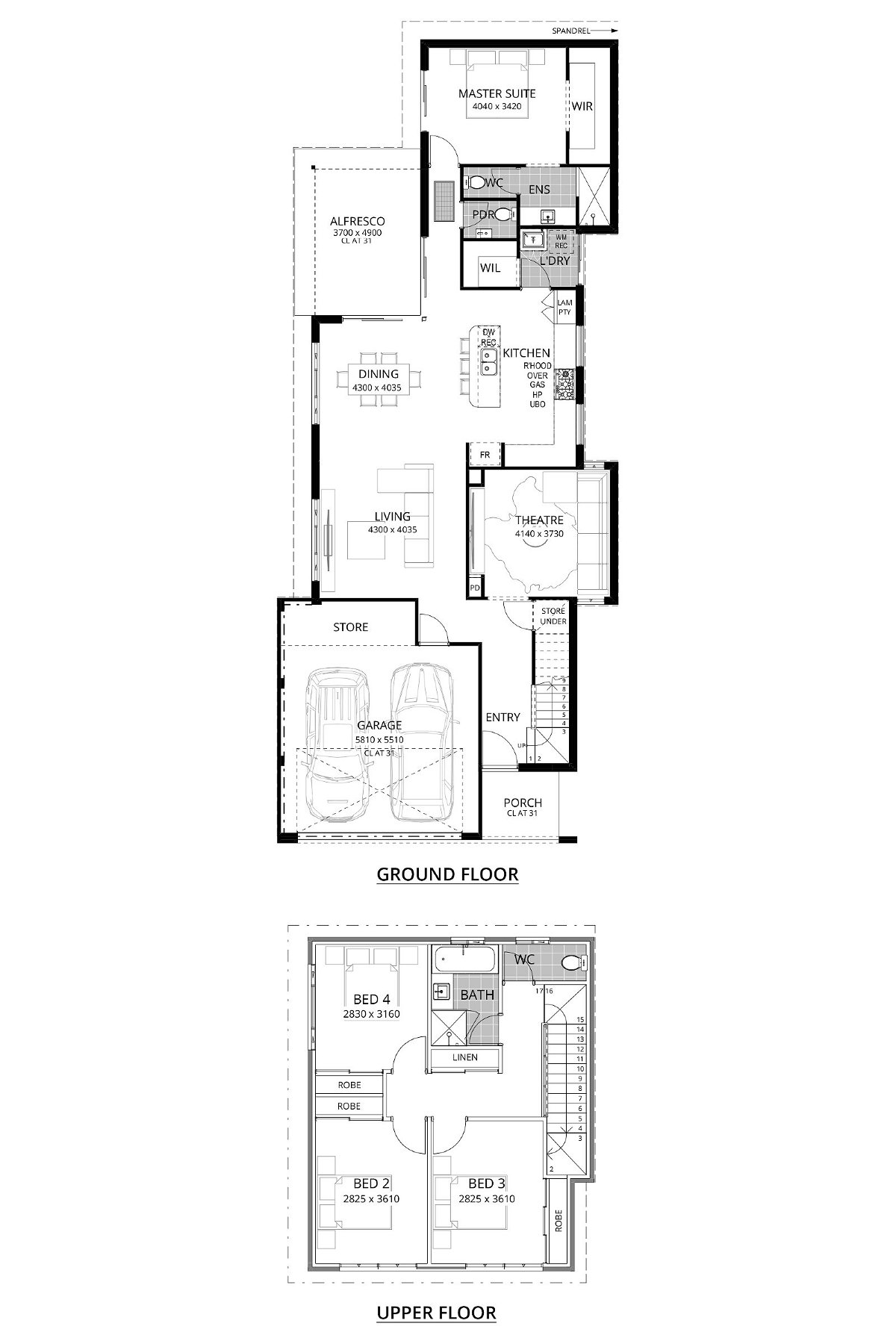

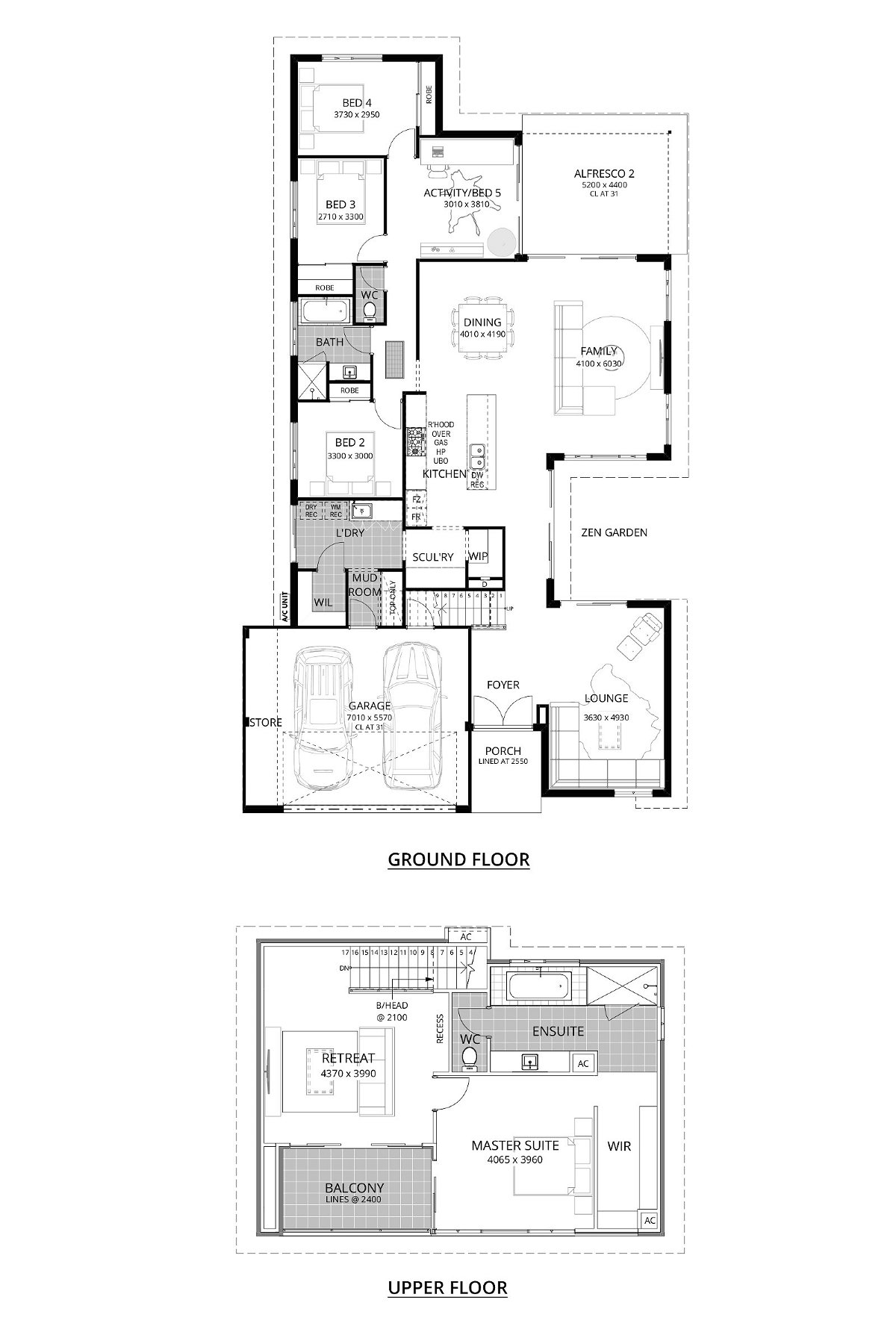

Our Designs

- Elevation

- Floorplan

Showing 1 - 30 of 122 designs